Friday, December 12, 2025

Friday, December 5, 2025

Saturday, November 29, 2025

Friday, November 28, 2025

Saturday, November 22, 2025

Friday, November 21, 2025

Saturday, November 15, 2025

Friday, November 14, 2025

Saturday, November 8, 2025

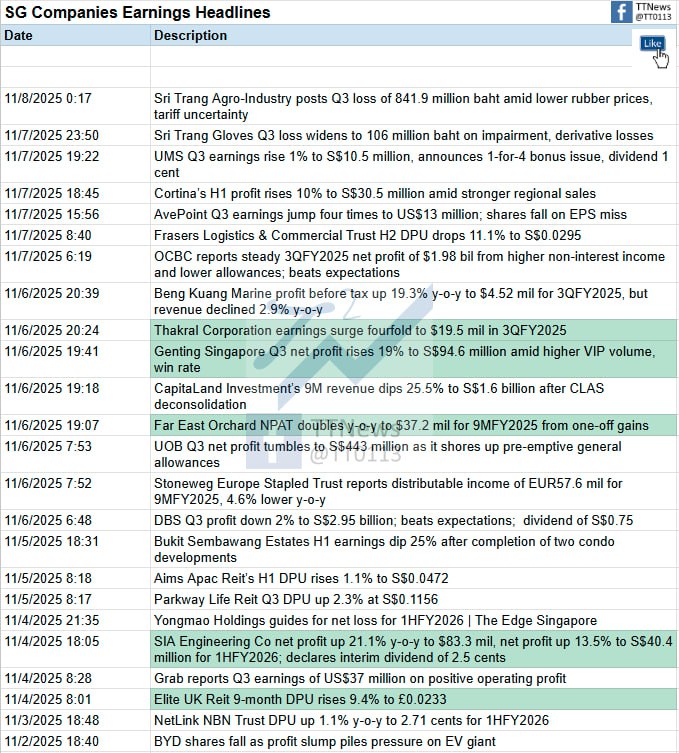

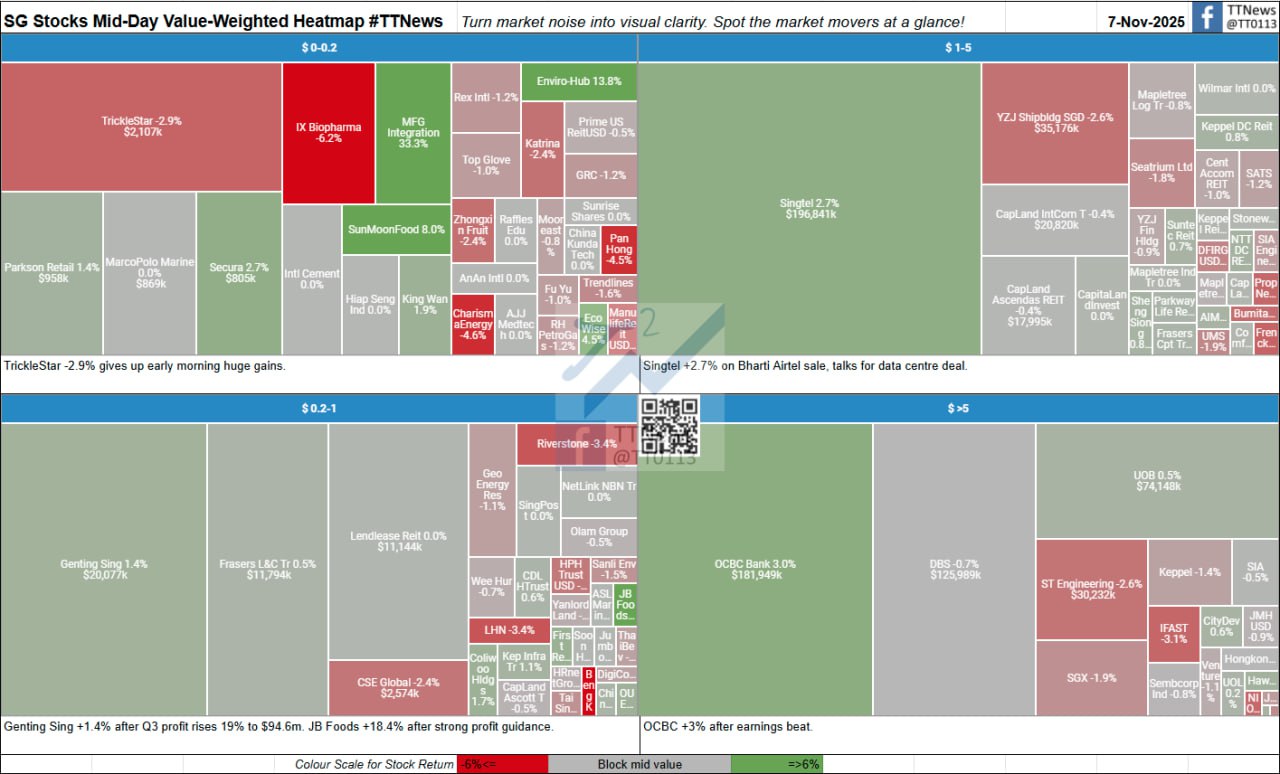

Friday, November 7, 2025

SG Stocks Mid-Day Value-Weighted Heatmap #TTNews $ 0-0.2: TrickleStar -2.9% gives up early morning huge gains. $ 0.2-1: Genting Sing +1.4% after Q3 profit rises 19% to $94.6m. JB Foods +18.4% after strong profit guidance. $ 1-5: Singtel +2.7% on Bharti Airtel sale, talks for data centre deal. $ >5: OCBC +3% after earnings beat. More here: https://linktr.ee/ttnews0113

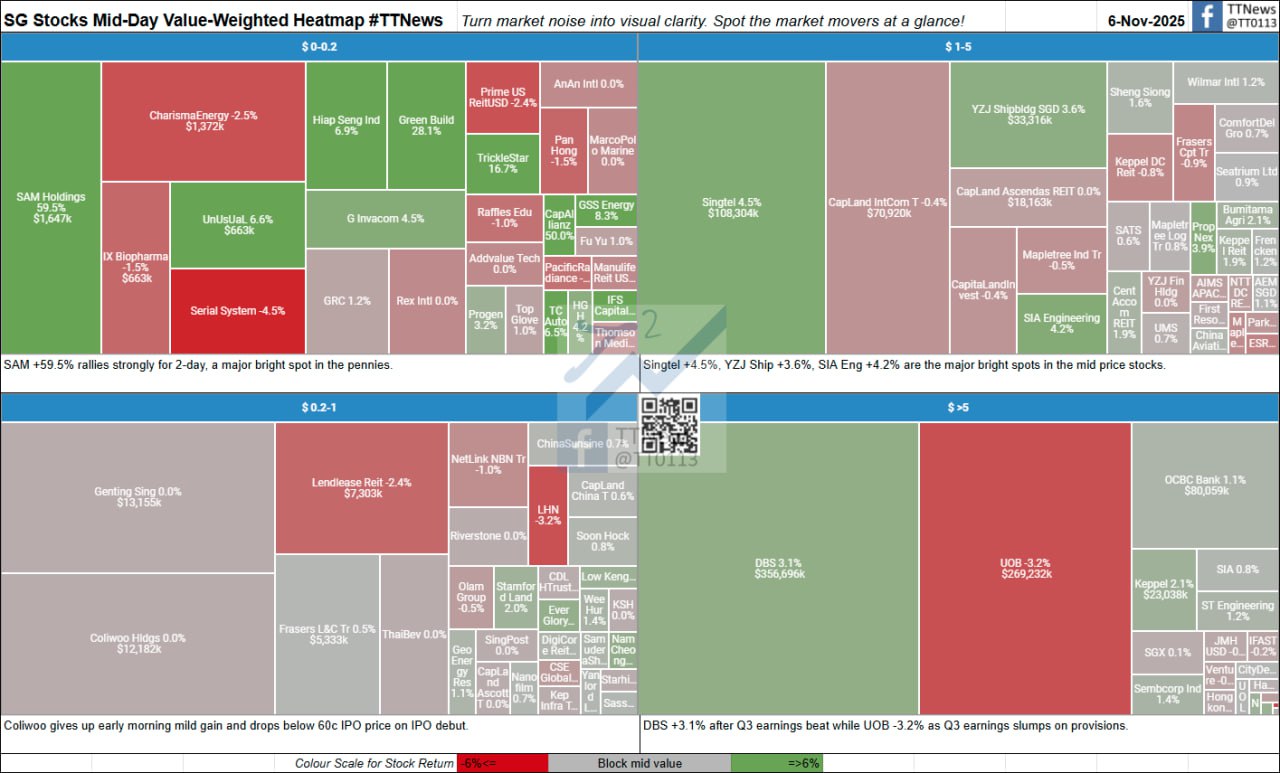

Thursday, November 6, 2025

SG Stocks Mid-Day Value-Weighted Heatmap #TTNews $ 0-0.2: SAM +59.5% rallied strong for 2-day, a major bright spot in the pennies. $ 0.2-1: Coliwoo gives up early morning mild gain and drops below 60c IPO price on IPO debut. $ 1-5: Singtel +4.5%, YZJ Ship +3.6%, SIA Eng +4.2% are the major bright spots in the mid price stocks. $ >5: DBS +3.1% after Q3 earnings beat while UOB -3.2% as Q3 earnings slumps on provisions. More here: https://linktr.ee/ttnews0113

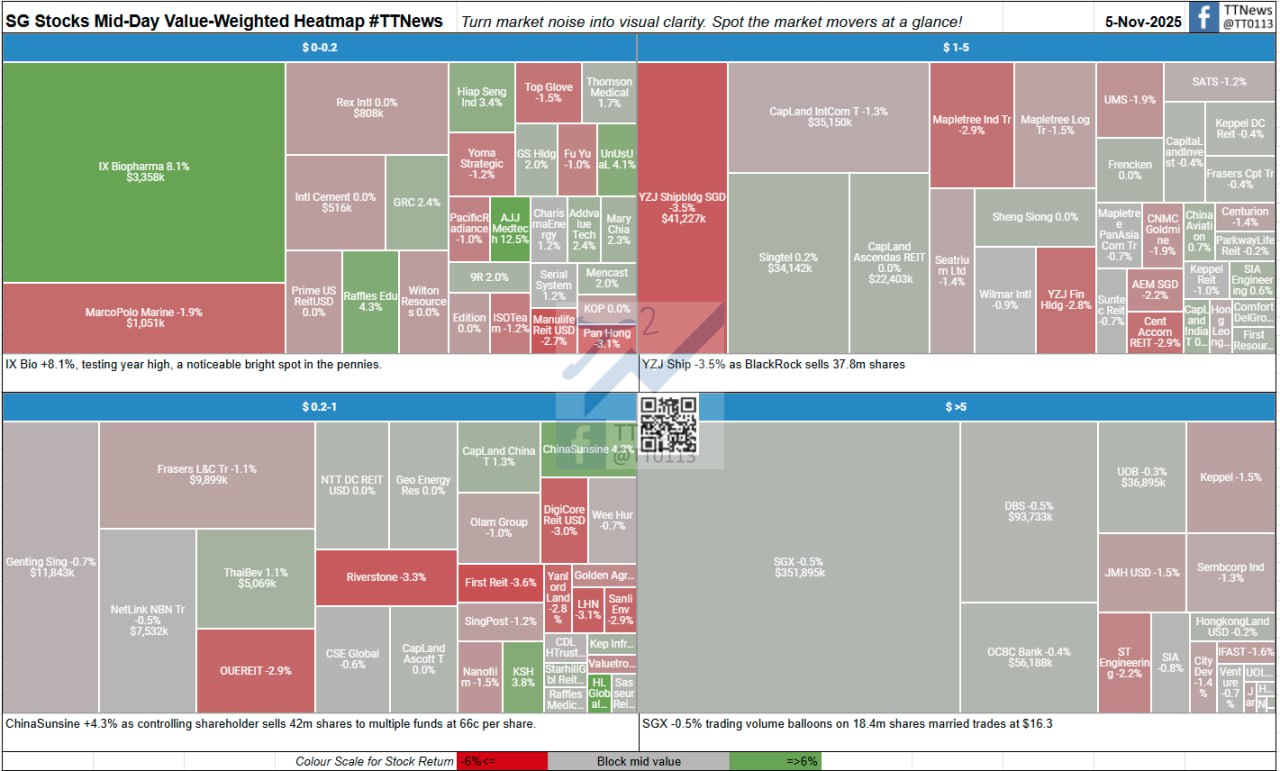

Wednesday, November 5, 2025

SG Stocks Mid-Day Value-Weighted Heatmap #TTNews $ 0-0.2: IX Bio +8.1%, testing year high, a noticeable bright spot in the pennies. $ 0.2-1: ChinaSunsine +4.3% as controlling shareholder sells 42m shares to multiple funds at 66c per share. $ 1-5: YZJ Ship -3.5% as BlackRock sells 37.8m shares $ >5: SGX -0.5% trading volume balloons on 18.4m shares married trades at $16.3 More here: https://linktr.ee/ttnews0113

Saturday, November 1, 2025

Friday, October 31, 2025

Saturday, October 25, 2025

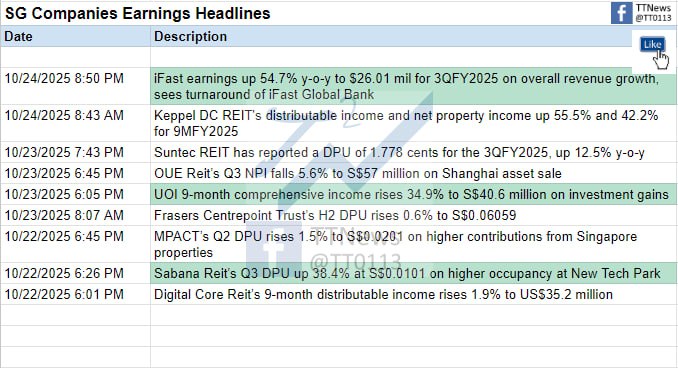

Friday, October 24, 2025

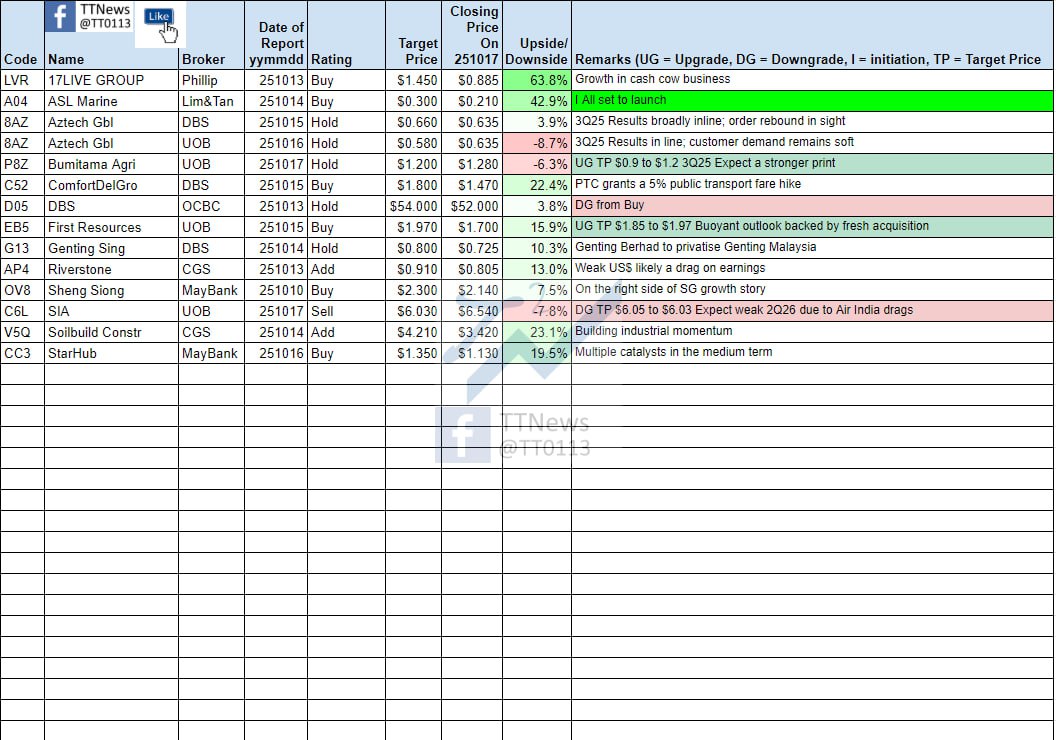

Friday, October 17, 2025

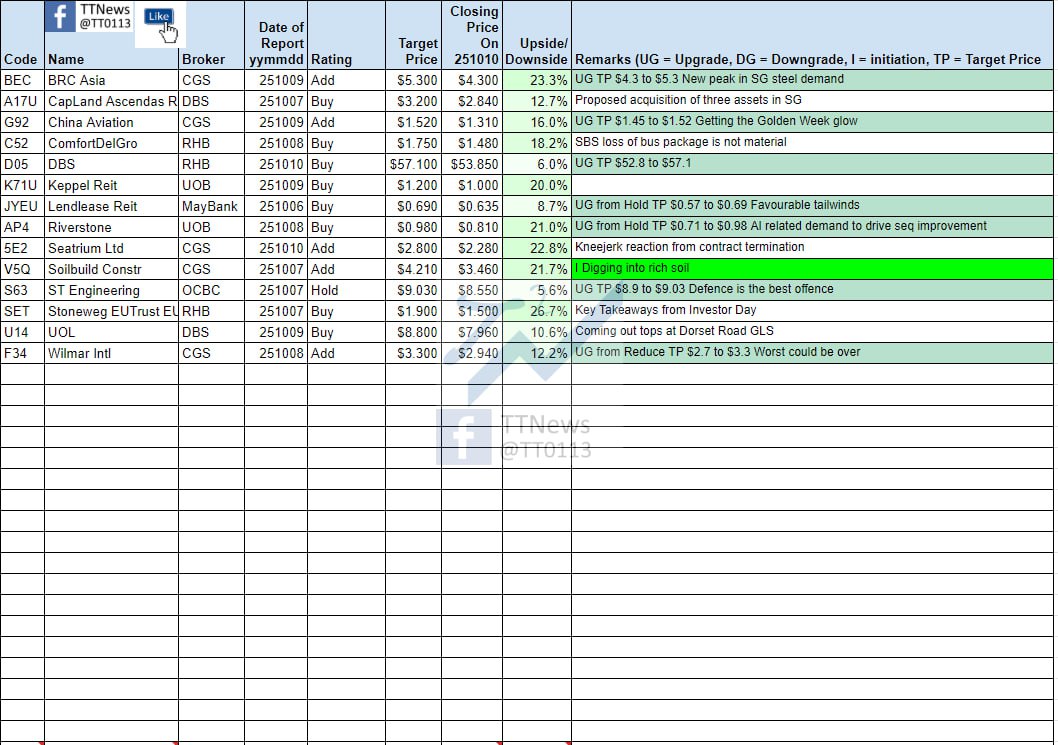

Friday, October 10, 2025

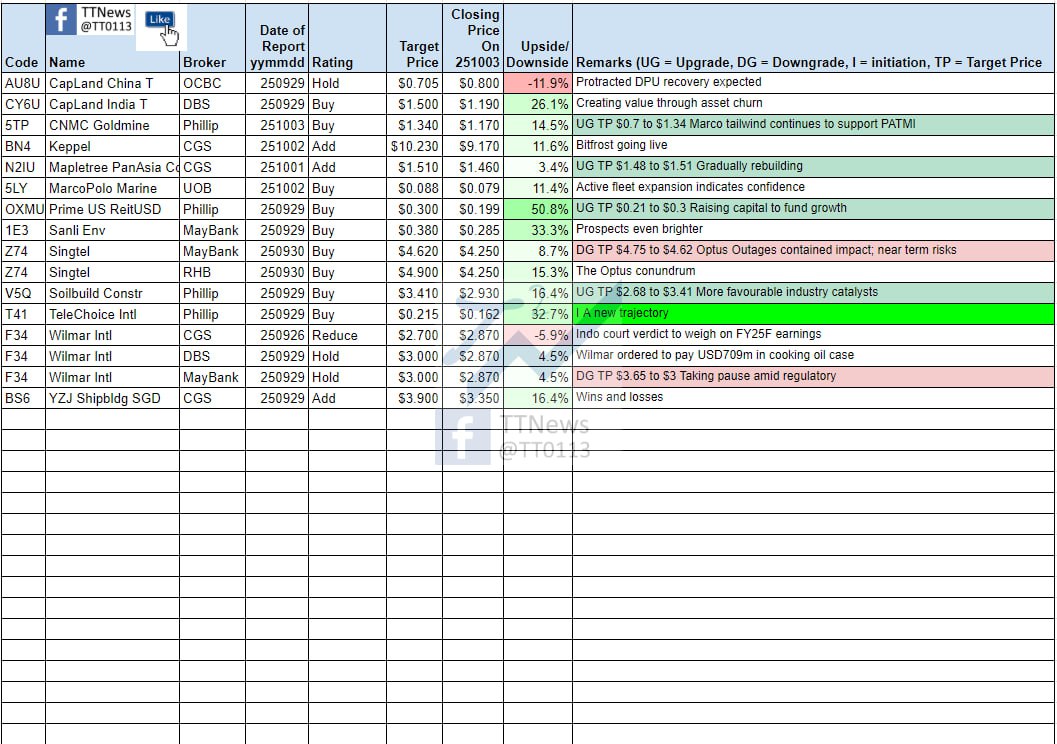

Friday, October 3, 2025

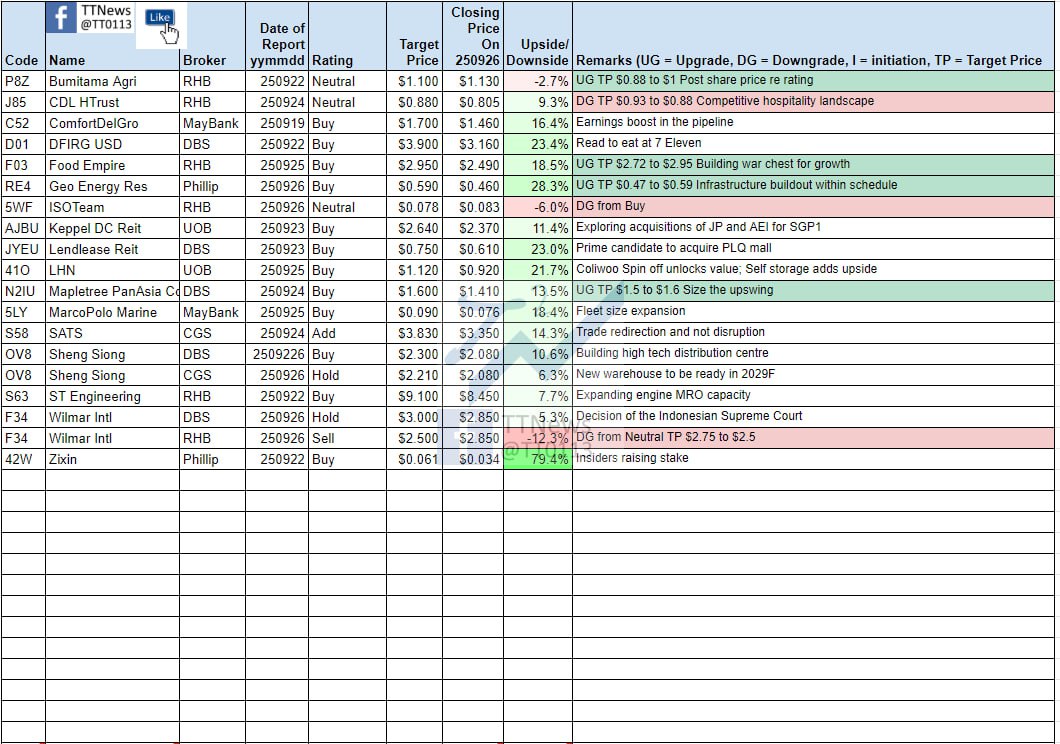

Friday, September 26, 2025

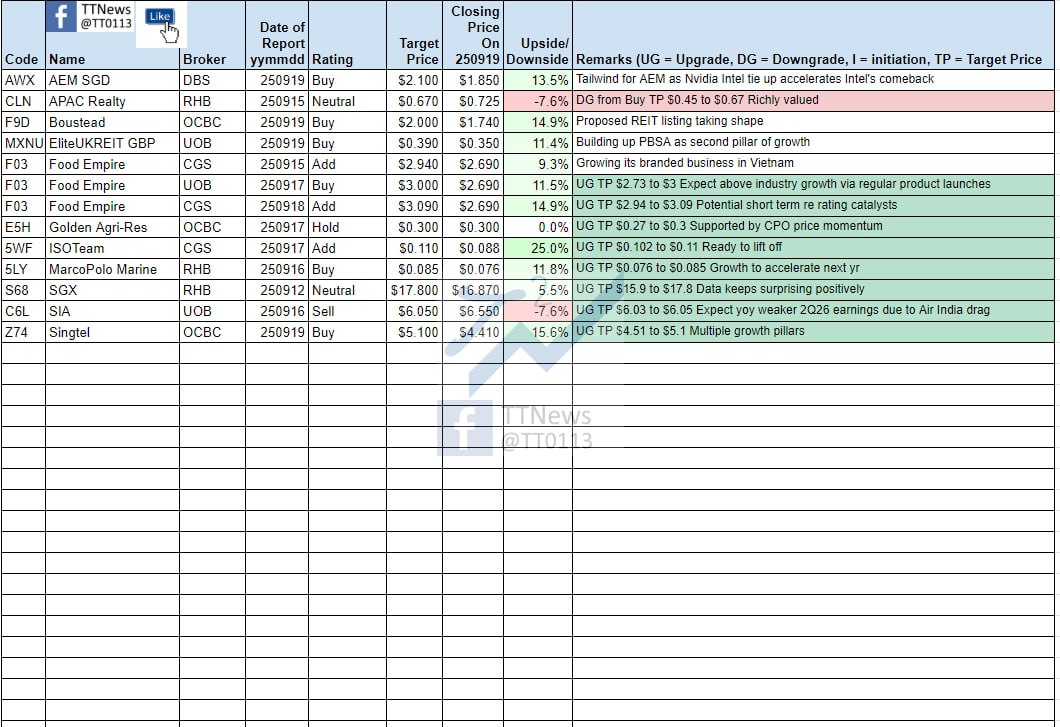

Friday, September 19, 2025

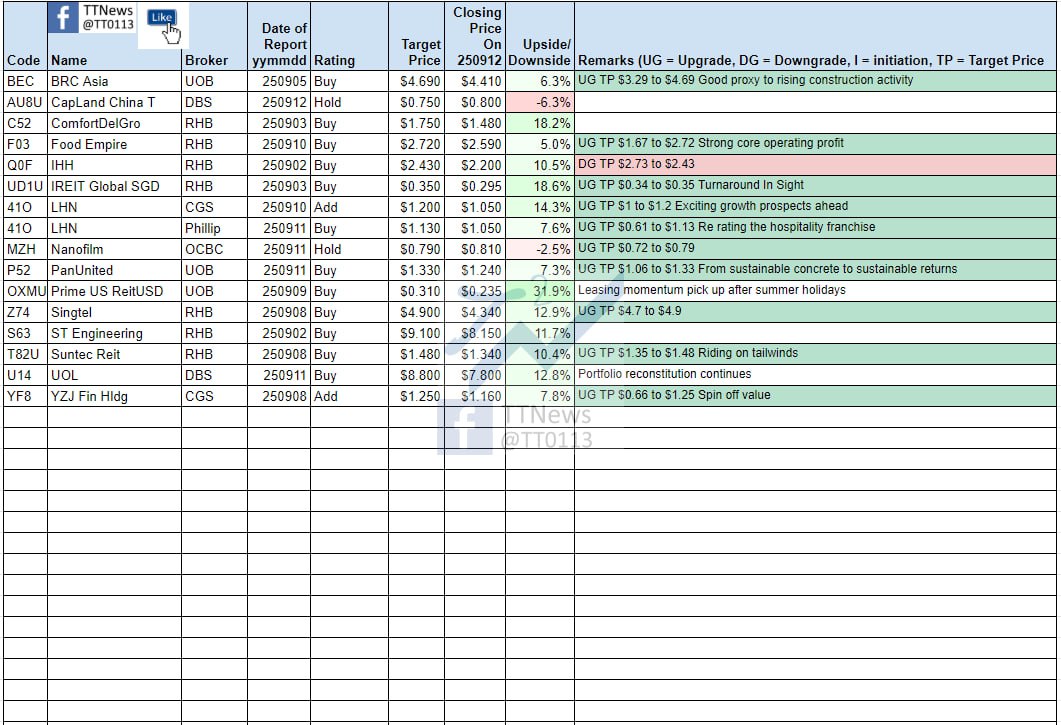

Friday, September 12, 2025

Friday, September 5, 2025

Saturday, August 30, 2025

Friday, August 29, 2025

Friday, August 22, 2025

Thursday, August 21, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Wednesday, August 20, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Tuesday, August 19, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Monday, August 18, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Saturday, August 16, 2025

Friday, August 15, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Thursday, August 14, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Wednesday, August 13, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Tuesday, August 12, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Monday, August 11, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Saturday, August 9, 2025

Friday, August 8, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Thursday, August 7, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

Wednesday, August 6, 2025

SG Mid-Day Top Volume Leader Board #TTNews #Stocks

STI unchanged ahead of DBS earnings; Koh Bro +7% breaks year high after subsidiary Koh Eco's positive profit guidance; Wee Hur +5.8% breaks year high on Australia lifting foreign student cap; HL Asia +3.9% breaks year high on strong construction outlook; Sanli +2.5% testing year highMore here: https://linktr.ee/ttnews0113

Monday, August 4, 2025

Saturday, August 2, 2025

Luckin Coffee (LKNCY): The Rollercoaster Story - The Rise, Scandal and Comeback

Luckin Coffee (LKNCY): The Rollercoaster Story - The Rise, Scandal and Comeback

When Luckin Coffee burst onto China’s café scene in 2017, it seemed destined to unseat Starbucks as the nation’s go-to coffee brand. But after a spectacular rise—and an even more spectacular collapse amid an accounting scandal—Luckin staged a remarkable comeback that’s still unfolding today. Here’s the story of how China’s homegrown coffee champion went from hero to zero and back again.

The Dazzling Ascent and Abrupt Downfall

Founded in October 2017 in Beijing, Luckin Coffee quickly disrupted the market with a technology-first strategy: app-based orders, convenient pick-up kiosks, and aggressive discounts. This innovative model allowed it to rapidly expand its store count, surpassing Starbucks in China by 2019 and becoming the country's top coffee brand. Its rapid growth culminated in a successful Nasdaq IPO in 2019, raising approximately US$561 million.

However, this impressive expansion concealed significant financial misconduct. In January 2020, short-seller Muddy Waters Research published an investigative report alleging falsified financial and operational figures. Although Luckin initially denied the claims, an internal investigation in April 2020 confirmed that its chief operating officer had fabricated approximately US$310 million in 2019 sales revenue. This revelation led to executive firings and a dramatic stock price crash. Trading was suspended, and Luckin was delisted from Nasdaq on June 29, 2020. The company subsequently filed for Chapter 15 bankruptcy in the US in February 2021 and settled SEC charges for US$180 million in December 2020, without admitting or denying the allegations.

Rising from the Ashes: Tech, Cost Control, and Supply Chain Excellence

Post-2020, Luckin embarked on a significant restructuring effort, emerging from bankruptcy in March 2022 after completing its financial debt restructuring under U.S. law. This included replacing most of its top management responsible for the fraud. Centurium Capital became a key backer and the controlling shareholder in January 2022, holding over 50% of the voting interest. By August 2022, Luckin fully redeemed its offshore debt securities, eliminating its only offshore debt.

Luckin's impressive comeback has been fueled by a renewed commitment to its app-driven, cost-efficient new retail model. Key elements of its strategic rebirth and growth, with a focus on technology, cost control, and supply chain management, include:

1. Tech Effort: The Digital Backbone

Luckin's business is deeply rooted in technology, covering every aspect from customer engagement to supply chain management.

- Mobile-First Customer Experience: Its mobile apps cover the entire customer purchase process, offering a cashier-less environment. Customers can easily choose stores, place advance orders, make payments, and receive real-time updates. The app also includes a live-streaming feature allowing customers to watch their drinks being prepared, building trust and offering a novel experience.

- Data-Driven Product Innovation & Customer Engagement: Luckin leverages data analytics to understand market dynamics and customer behavior. This enables differentiated new product recommendations and accurate pricing to boost transactions. The company constantly rolls out new products, launching nearly 90 new SKUs in 2024, with blockbusters like the Coconut Milk Latte (over 700 million cumulative sales by April 2024) and the Fruity Americano series (Orange Americano surpassing 100 million cups by March 2024).

- Operational Efficiency through Digitalization: Luckin has achieved complete digitalization of operations. This includes:

- Expanding Digital Reach: Luckin focuses on building "private domain traffic" within its own app and Weixin ecosystem, cultivating a comprehensive private domain ecosystem to acquire and retain customers through continuous consumption.

2. Cost Control: Driving Affordability

Luckin's model emphasizes cost advantages to provide high affordability to customers.

- Streamlined Store Formats: The strategic focus on pick-up stores (98.9% of self-operated stores by end of 2024) with limited seating and small sizes (typically 20-60 square meters) allows for low rental and decoration costs. Average renovation costs per store were around RMB200,000 in 2024.

- Vertical Integration in Supply Chain: To control costs of raw materials, Luckin has implemented vertical integration:

- Operational Efficiency: The technology-driven approach leads to highly efficient store operations and workforce management, improving per capita output.

- Strategic Discounting and Marketing: While known for aggressive initial discounts, Luckin now uses incentive programs like coupons and discount vouchers to manage effective selling prices and attract/retain customers. The company's multi-channel branding and advertising strategy includes collaborations with popular cultural and sports icons and leveraging social media platforms to promote products.

3. Supply Chain Management: Quality and Reliability

Luckin emphasizes a strong supply chain with high resilience and premium quality.

- Direct Sourcing and Quality Control: The company sources premium Arabica coffee beans and other high-quality raw materials from selected suppliers. It has deepened penetration into the upstream of its supply chain through meticulous recipe design and stringent control over the entire production process to guarantee product quality.

- Roasting and Processing Facilities: Luckin has invested in its own fully automatic intelligent coffee roasting facilities in Kunshan, Jiangsu, and Pingnan, Fujian, with another under construction in Qingdao, Shandong, and plans for one in Xiamen, Fujian. It also operates a green coffee bean processing facility in Baoshan, Yunnan.

- Inventory and Logistics: A smart supply chain management system integrates intelligent warehousing and order management, enabling accurate demand prediction and inventory management. Luckin works with selected delivery companies and warehouse/fulfillment service providers, with approximately 99.9% of orders delivered on time in 2024. The company sends staff to leased warehouses regularly to ensure proper storage and adherence to food safety protocols.

Scaling New Heights and New Challenges

Luckin's strategic efforts have translated into significant financial recovery and expansion. As of December 31, 2024, the company operated 14,540 self-operated stores and 7,749 partnership stores across over 300 cities in China, including Hong Kong, with an additional 51 self-operated stores in Singapore. It has also recently expanded into Malaysia via franchise rights. By the end of 2024, Luckin had amassed 334.0 million cumulative transacting customers.

Financially, Luckin reported total net revenues of RMB34,474.8 million (US$4,723.9 million) in 2024, a 38.4% increase from 2023. The company achieved an operating income of RMB3,538.1 million (US$484.8 million) and a net income of RMB2,931.7 million (US$401.7 million) in 2024, marking a strong return to profitability. By 2023, Luckin had surpassed Starbucks to become China’s top coffee chain in both revenue and store count. Its OTC-traded shares have rebounded over 38 times from their 2020 lows.

In a bold move, Luckin debuted in New York City in June-July 2025, launching two app-only pickup stores. Its U.S. strategy mirrors its successful China playbook: app-first ordering, minimal-store formats, loyalty rewards, and aggressive promotional pricing (e.g., US$1.99 introductory drinks).

However the U.S. expansion has its unique challenges. The app-only, no-cash model, while efficient in China, has met with complaints from some U.S. consumers who prefer in-person ordering or cash payments. Additionally, while Luckin's prices are lower than Starbucks without coupons, they are not significantly cheaper than other affordable U.S. coffee chains like Dunkin' or McDonald's, suggesting a different market positioning challenge in the U.S..

Luckin Coffee's story is truly a unique comeback. Its digital-first, low-cost, and vertically integrated model has proven incredibly effective in China and is now being tested on the global stage. Whether it can redefine the global coffee landscape and maintain investor confidence will depend on its ability to navigate cultural nuances, sustain its competitive edge, and uphold stringent governance standards. Time will tell.

Reference

https://investor.lkcoffee.com/static-files/a171f854-0b83-4a0b-b00c-bfa752887010

https://en.wikipedia.org/wiki/Luckin_Coffee