Economists call it Quantitative Easing - monetary policy whereby central bank buys predetermined amounts of government bonds or other financial assets in order to add money directly into the economy.

We also call it “money printing”.

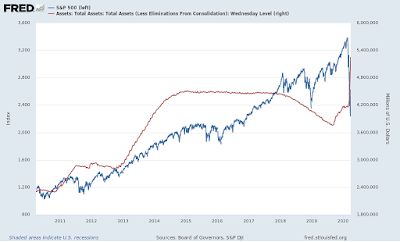

The “money printing” was reflected by the increase in the total assets on the US central bank (Federal Reserve - FED) balance sheet.

Over the past two weeks, about US$580b was "printed" as FED’s total assets increased from US$4.67t to US$5.25t to inflate the economy deflated by COVID-19!

From the start of the year, US$1.08t was "printed", from US$4.17t on 1 Jan to US$5.25t on 25 Mar